The IRS made sizable adjustments to several tax limits in response to the high inflation levels from 2022. Taxpayers will see increases in tax brackets, the standard deduction, and the gift tax exclusion for 2023.

STANDARD DEDUCTION

For 2023, single taxpayers who don’t itemize will have a $13,850 standard deduction, and married couples filing jointly will have a $27,700 deduction. And heads of households get a $1,400 bump from 2022 to $20,800.

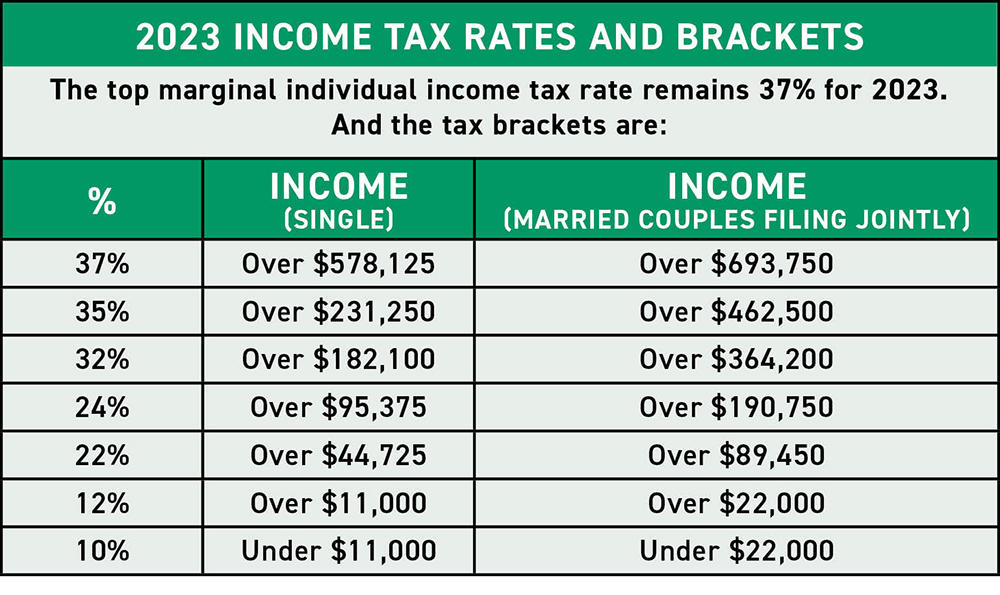

2023 Income Tax Rates and Brackets

The top marginal individual income tax rate remains 37% for 2023. Please see chart for the other tax brackets.

LARGER GIFTS

Each individual can give someone a gift of up to $17,000 tax-free in 2023. This is a $1,000 increase from 2022.

FLEX SPENDING ACCOUNTS

The new IRS limit for Flexible Spending Account (FSA) contributions for 2023 is $3,050, an increase of about 7% from the previous tax year’s threshold of $2,850. Calculate contributions carefully, as you’ll lose unused funds.

401(K) AND IRA LIMITS

The contribution limit for employees who participate in employer-sponsored retirement plans is increased to $22,500, up from $20,500. And catch-up contributions for workers aged 50 and over increase to $7,500, up from $6,500.

The limit on annual contributions to an IRA increased to $6,500, up from $6,000. The IRA catch-up contribution limit remains $1,000.