Social Security recipients will receive an 8.7% increase in their 2023 payments.

Source: https://www.ssa.gov/news/press/factsheets/colafacts2023.pdf

Social Security recipients will receive an 8.7% increase in their 2023 payments.

Source: https://www.ssa.gov/news/press/factsheets/colafacts2023.pdf

Kristen owns a small pet-sitting business and is concerned about inflation impacting her company’s finances. What are some things she can do to help alleviate the pressure inflation is having on her business?

Reducing expenses is the first step to protect her business against price increases. Kristen should also send out invoices immediately after she completes a project and not wait to invoice at the end of the month. And along the same lines, keep on top of receivables. Don’t let customers continue to book services without paying for previous work. And better yet, she should require immediate payment, either at the time of booking or after an assignment. The sooner she can get paid, the more spending power that money will have.

If Kristen can stock up on critical supplies like leashes, treats, or pet waste bags, she can lock in current costs and avoid future price increases.

And she should work toward engaging in more lucrative assignments.

Client Profile is based on a hypothetical situation. The solutions discussed may or may not be appropriate for you.

The new year means it’s time to make your resolutions. But it also means another tax season is here. Take time in January to get organized to make tax filing smooth for you and your tax professional.

You’ll receive the bulk of your tax forms by January 31. But if you believe you’re missing one, contact the appropriate company to request a copy.

Along with tax forms, you’ll want to get other financial documents and information together before meeting with your tax professional. Consider if you have:

Most tax professionals will provide you with their tax organizer that will walk you through all tax areas that may apply to you, so you don’t overlook anything.

Taking advantage of the latest technology can help ensure your company’s infrastructure is safe and secure.

Machine learning and artificial intelligence are becoming more accessible. Deep learning is being used to analyze data such as logs, transactions, and real-time communications to detect threats or unwarranted activities.

Behavioral analytics help determine patterns in system and network activities to detect potential and real-time cyber threats. For instance, an abnormal increase in data transmission from a specific user device could indicate a possible cyber security issue.

Passwords and PINs have been the benchmark of technology security. But we all know they are subject to breach. Embedded hardware authentication is becoming a reality. These powerful user authentication chips are embedded into the hardware itself. Designed to revolutionize ‘authentication security,’ these employ multiple levels and methods of authentication working in tandem.

Self-encrypting drives encrypt data as it is being written onto the disk. Each disk has a data encryption key to encrypt data as it’s being written onto the disk and decrypt it as it is being read from it.

Is student loan debt forgiveness taxable?

Thanks to the American Rescue Plan Act enacted in 2021, student loan debt forgiveness isn’t considered taxable income on your federal tax return. This exclusion from income is valid for any student loans forgiven in 2021 through 2025. Starting in 2026, the old rules will apply, making student debt forgiveness taxable.

But your state may have different tax rules for student loan forgiveness. Currently, a handful of states consider it taxable income. So, if you have questions about your situation, speak with your tax professional.

The start of the new year is the perfect time to review your tax withholding and make changes if necessary.

Start by looking at your 2021 tax return. Did you receive a large refund, or did you have to write a hefty check? In either case, it may indicate your paycheck withholding is out of sync with your tax reality.

Looking to 2023, do you expect to have any life changes? For example, do you plan to get married or have a child? Are you planning to start a side business? Will you need to begin caring for aging parents? Life changes can impact your 2023 tax liability.

The IRS offers a Tax Withholding Estimator that may help you determine if you need to withhold more or less from each paycheck: https://www.irs.gov/individuals/tax-withholding-estimator. If you believe you need to make changes to your tax withholding, speak with your tax professional to understand what you should change. You can request a blank Form W-4 from your payroll department or the IRS.gov website.

With Social Security benefit payments increasing nearly 9% this year, you may need to rethink your retirement tax planning.

If you started working part-time to offset some of the recent price inflation, this increase in your Social Security payments might make some or more of it subject to federal income taxes. If you file as an individual and your combined income is between $25,000 and $34,000, up to half of your benefit may be subject to income taxes. Social Security defines combined income as your adjusted gross income, plus nontaxable interest, plus one-half of your Social Security benefit.

With the possibility of being in a higher tax bracket this year, due to increased Social Security benefits, consider cutting back on withdrawals from your qualified retirement plans. If you can avoid taking more than your required minimum distribution (RMD) in 2023, you might be able to limit your tax liability.

If you need more than your RMD, consider pulling funds from a taxable brokerage account where you’ll pay the lower long-term capital gains rates if you held investments for more than a year.

Also consider qualified withdrawals from a Roth IRA, a Roth 401(k), or a health savings account (HSA), which would not be subject to federal income tax and wouldn’t have an impact on how your Social Security benefit is taxed.

This year’s cost of living adjustment can help you keep up with higher prices. And in the short run, managing your withdrawals may help you smooth out the tax bumps during a period of high inflation.

Figuring out withdrawals from retirement and brokerage accounts can be complicated, so it may help to work with an advisor. But even if you do it yourself, try to withdraw from your Roth and HSA accounts last, allowing those assets to grow tax-free longer. Withdrawals from all three types of accounts in the same year can help manage combined taxable income.

Inherited real estate generally does not trigger these taxes: estate, gift, capital gains or income. That’s because, under tax law, the starting value of the house is generally the property’s fair market value at the time of the homeowner’s death. This is known as the “step up in basis” and means that you may have a capital gain or loss if you sell the property after you inherit it.

However, if you choose to use the home as your primary residence for two of the five years preceding the sale of the home, you’ll probably qualify for the primary residence tax exclusion of up to $250,000 if single ($500,000 if married filing jointly) in capital gains.

Be sure to change the ownership records with your local government, which requires providing copies of the decedent’s will and death certificate and drafting and filing a new deed.

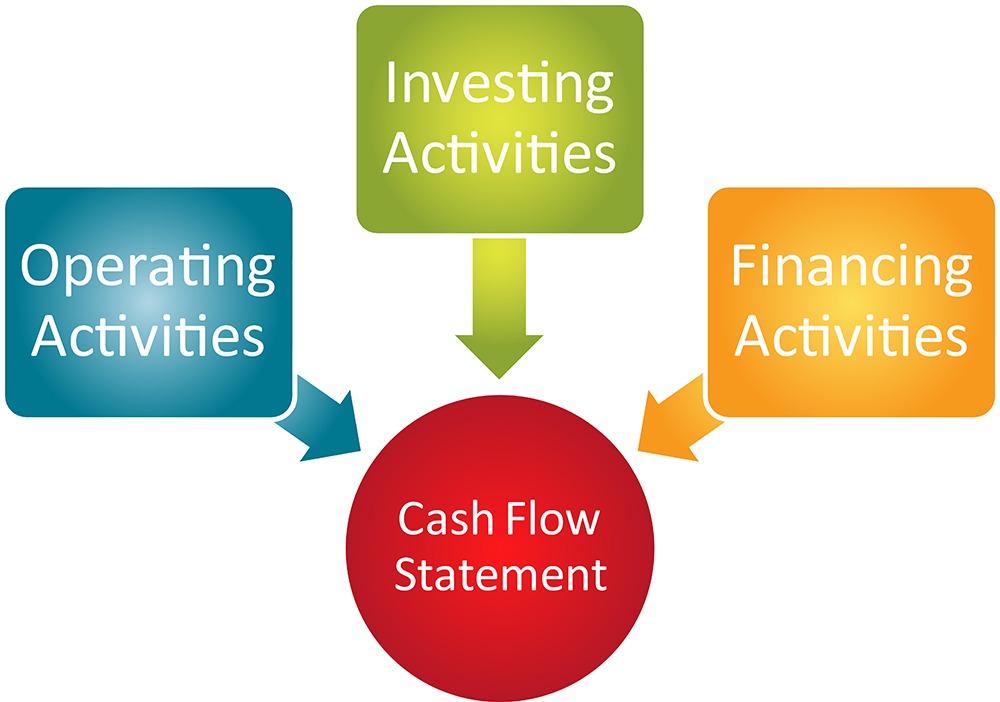

Managing cash is vital for running a successful business. That is why reviewing your company’s cash flow statement regularly is so important.

Your cash flow statement provides important context to information that might not appear on a different financial statement. For example, revenue from a new sale often appears on an income statement and contributes to the company’s overall profit or loss. However, if an invoice isn’t due immediately or the company extends a line of credit to the customer, the actual cash may not hit the company’s bank account for months.

A cash flow statement is broken into three sections to show the primary sources and uses of your cash.

Though a cash flow statement can’t tell you everything about a company’s financial viability, there are some things to watch out for that can be particularly revealing.

Is there a positive cash flow coming from your core business operations?

Also, look at the financing section. Are you bringing in most or all your cash from loans? This might be okay for a startup business, but not for a company that’s established.

Understand Your Cash Flow Statement – managing cash is vital for running a successful business.

Inheriting a House – inherited real estate does not trigger estate, gift, capital gains or income taxes

Taxes in Retirement – with social security benefit payments increasing nearly 9% this year, you may need to rethink your retirement tax planning.

Updating Your W-4 – the start of the new year is the perfect time to review your tax withholding and make changes if necessary.

January 2023 Question and Answer

Improve Online Security for Your Business – taking advantage of the latest technology can help ensure your company’s infrastructure is safe and secure.

Get Ready for Tax Time – take time in January to get organized to make tax filing smooth for you and your tax professional.

Social Security Payment Increase – social security recipients will receive an 8.7% increase.