On average, 401(k) plans with an automatic enrollment feature have a 20% higher participation rate than plans without, according to Bankrate.com.

ENTER THE SECURE 2.0 ACT

Automatic enrollment is about to become more “popular.” If you’re a new plan sponsor or contemplating adding a 401(k) plan to your benefits package, the SECURE 2.0 Act may have taken the decision of whether or not to include automatic enrollment in your plan out of your hands. Under the Act’s provisions, starting in 2025, many 401(k) and 403(b) plans set up after 2022 must automatically enroll all employees who meet their company’s plan eligibility requirements.

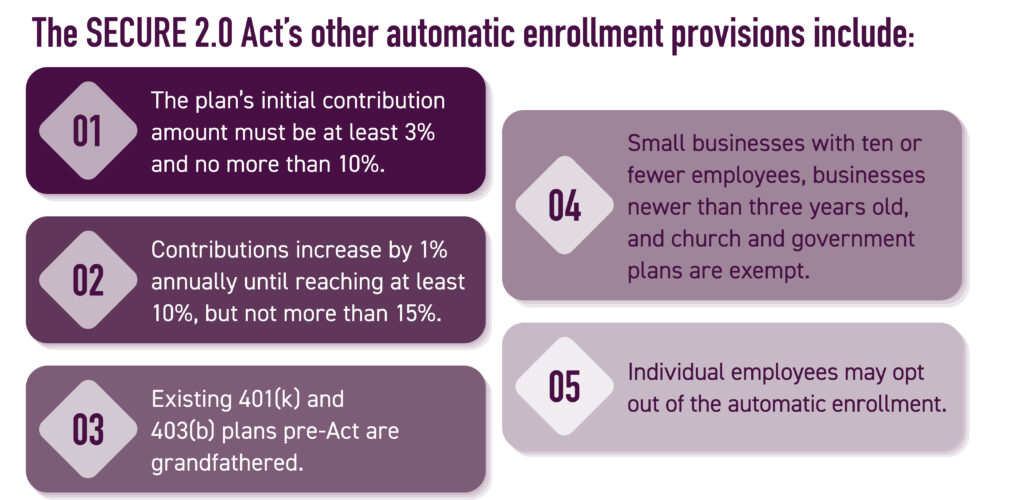

The SECURE 2.0 Act’s other automatic enrollment provisions include:

- The plan’s initial contribution amount must be at least 3% and no more than 10%.

- Contributions increase by 1% annually until reaching at least 10%, but not more than 15%.

- Existing 401(k) and 403(b) plans pre-Act are grandfathered.

- Small businesses with ten or fewer employees, businesses newer than three years old, and church and government plans are exempt.

- Individual employees may opt out of the automatic enrollment.