The 2025 Social Security Board of Trustees Report projects the maximum wage subject to Social Security taxes will rise to $184,500 in 2026, up $8,400 from 2025’s $176,100 cap. Employees and employers each contribute 6.2% (totaling 12.4%) to Social Security, while employees also pay a 1.45% Medicare tax, with an additional 0.9% tax applied to wages exceeding $200,000. Self-employed individuals cover the full 12.4% Social Security tax.

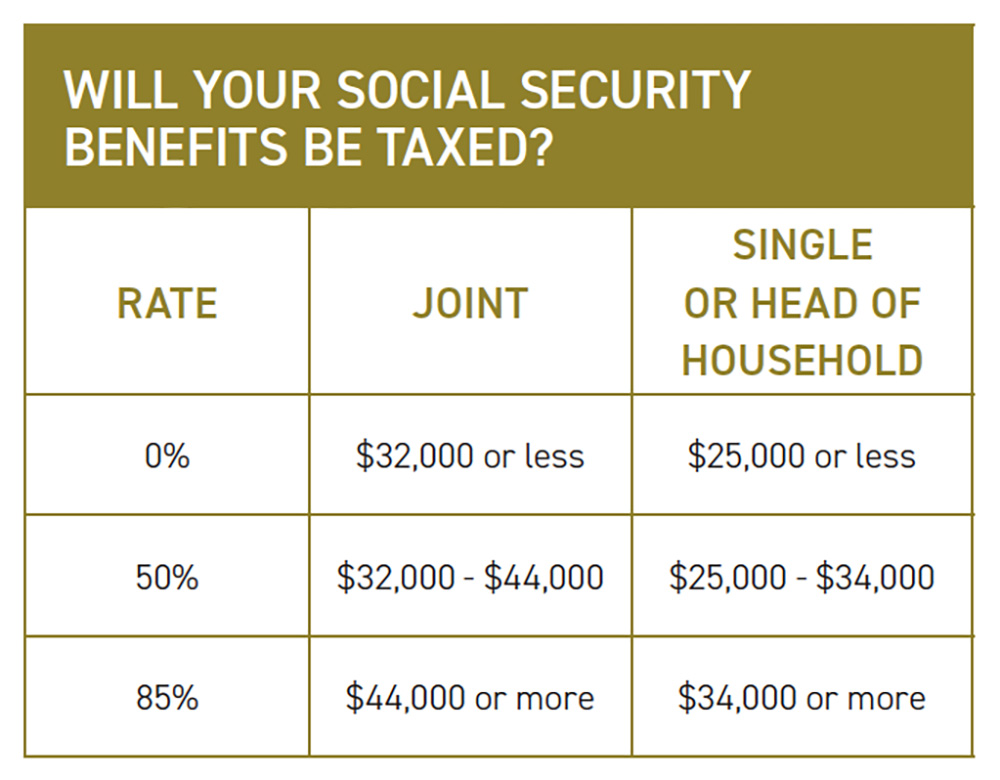

Retirees may face taxes on up to 85% of their Social Security benefits, depending on their provisional income. This includes other taxable income, tax-exempt interest, and half of their Social Security benefit.

To estimate your 2026 tax liability, review your income sources, consult the IRS guidelines, and talk to your tax advisor. Stay informed to plan effectively for your financial future.