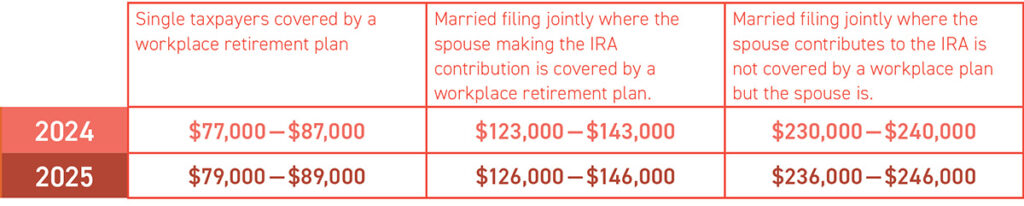

This chart shows the income phase-out range for deductible contributions to a traditional IRA.

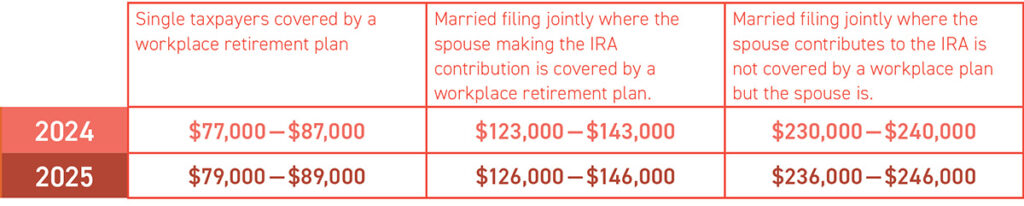

This chart shows the income phase-out range for deductible contributions to a traditional IRA.

I’m getting ready to prepare and file my 2024 tax return and heard I could open a traditional IRA this year and deduct contributions from last year’s income on my tax return. Is that true?

Anyone with earned income can open a traditional IRA before the tax filing deadline and contribute up to $7,000 of earnings ($8,000 if over age 50) for 2024 (and 2025), but they must qualify by income to get a tax deduction. (You can’t deduct contributions to a Roth.)

The deductibility phases out at different income levels depending on your filing status and whether you or your spouse has a qualified retirement plan at work. This means if your Modified Adjusted Gross Income (MAGI) is below the stated range, you can contribute the full amount to an IRA. But if your MAGI falls within this range, your contribution limit is reduced progressively until you cannot contribute at all if your MAGI exceeds the range.

With annual 2024 contributions limited to $7,000 ($8,000 for those age 50 and older), your retirement security can’t afford you making mistakes with your IRA. Yet many IRA investors do.

Younger people have many financial buckets to juggle: student loans, car loans, and the expenses of a first-time apartment or home. That doesn’t mean you should ignore saving for retirement. It may bring a modem of reassurance to know that while an IRA is not an emergency fund, you may be able to access IRA money without tax or penalties for a financial emergency. Premature withdrawals aren’t ideal for anyone, but they’re generally better than not contributing to an IRA as early as possible.

Married couples with one earner may forget that they can make annual contributions on behalf of a spouse who is not working. As long as the earning spouse has enough earned income to equal the contributions, each spouse may contribute up to $7,000 ($8,000 for ages 50 and older) to an IRA for the 2024 tax year.

Tax-sensitive procrastinators may make IRA contributions until the April 15, 2025 tax filing deadline. However, keep in mind that last-minute contributions give your investments less time to compound and you potentially have less money for retirement. If you can’t make your contribution all at once at the beginning of the year for optimal compounding, use a monthly contribution strategy to contribute the most you can, the earliest you can. It makes a big difference over the years.

Older IRA owners no longer have to end contributions to traditional IRAs at age 70 1/2, thanks to the Secure Act. Like the Roth IRA, contributions are allowable for people of any age. So long as you have earned income and can afford to contribute to an IRA you have options. Remember that a Roth IRA has no required minimum distributions and contributions are not tax deductible, unlike traditional IRAs.

Are you thinking of an IRA rollover? Getting these three rules right is critical if you want to avoid a big tax bill.

Your rollover must be completed within 60 days of withdrawal, or it’ll be taxable. You’ll also get hit with a 10% early distribution penalty if you’re under the age of 59 1/2. If you miss the 60-day limit, you may qualify for a rule waiver. The late rollover must be due to one of the IRS specified reasons and completed within 30 days after the specific reason for failing to meet the 60-day requirement.

This rule applies in aggregate to IRAs and Roth IRAs. If you have both types of IRAs, you are still limited to just one 60-day rollover in a IRS-month period. Additional rollovers can result in federal income tax and possible early withdrawal penalties. Some specific exceptions apply.

If you received a cash distribution, cash must be deposited in the rollover IRA. Similarly, if you took your distribution in stocks, you must deposit the same stock shares in the rollover IRA.

Talk to your tax professional.

Time to shore up your retirement security. For example, if you haven’t made a maximum contribution to an IRA for 2023, you have until the 2023 filing date for your personal tax return — April 15, 2024 — to max out your account. For the 2023 tax year, you can contribute up to $6,500 ($7,500 if you’re age 50 or older).

These contributions are tax-deductible as long as personal adjusted gross income (AGI) for 2023 doesn’t exceed $73,000 (filing single or head of household) and $116,000 (joint filers). Deductibility is phased out from $73,000-$83,000 and $116,000-$136,000.

If your 2023 IRA contribution won’t be deductible, consider a Roth IRA. While these contributions are made after tax, qualified distributions are tax-free, and you won’t have to take any minimum distributions during your lifetime. The amount you can contribute to a Roth IRA for 2023 is phased out with AGI between $138,000 and $153,000 (single and head of household filers) and $218,000 and $228,000 (joint filers).

What about company contributions to your employer-sponsored retirement plan on behalf of yourself and other employees? These contributions must be deposited by the due date of your business tax return. Assuming your business and retirement plan have calendar fiscal years, the 2023 contributions must be made by the due date of the 2023 company tax return to be deductible.

For a corporation, that due date is probably April 15, 2024, without an extension, or October 15, 2024, if a six-month extension is received. It’s okay if the contribution is made after the tax return is filed, so long as the deposit is made before the tax return is due.

Different due dates apply to sole proprietors, partnerships, LLCs, and other entities. Confirm your contribution deadline when you provide your tax professional with your 2023 tax filing information.

Naming grandchildren as beneficiaries of traditional IRAs used to be a popular estate-planning strategy. Grandchildren had their lifetimes to empty an inherited IRA, which also let them stretch out income-tax payments on the assets.

Under 2020 required minimum distribution (RMD) changes, grandchildren must now generally withdraw inherited IRA assets within ten years. That means upping annual required minimum distributions (RMDs) and potential yearly taxes. The tax bill can be particularly onerous if the distributions fall during the grandchild’s (or their parent’s if they’re minors) highest earning years. In addition, inherited IRAs have other complications. The beneficiary can’t convert an inherited traditional IRA to a Roth IRA. Nor can they add money to an inherited IRA or combine it with their own IRA.

Suppose you named a grandchild as a beneficiary of your traditional IRA before 2020. Given the RMD changes requiring a shorter distribution period, you should review your planning and consider whether other transfer strategies might be more beneficial.

Look at converting your traditional IRA to a Roth IRA. You can convert over several years to help minimize the annual tax bite. Yes, you’ll essentially be prepaying the income tax. But once the money is in the Roth IRA, it’ll grow tax-free, and the grandchild can take money from the Roth IRA tax-free once they inherit it. Several rules apply, so work with your tax professional.

Concerned about how a younger grandchild might use or squander the inherited IRA assets? Then you might consider leaving your IRA to a trust benefiting your grandchild.

A trust allows you to direct your chosen trustee to distribute the money to your grandchild according to the terms you set in the trust document. For instance, you might provide that larger sums of money can be withdrawn only to pay for college expenses or purchase a house.

Trusts can be complicated and may not reduce taxes on the IRA benefits. Before changing your current IRA distribution strategy, consult an adviser well-versed in inherited IRAs.