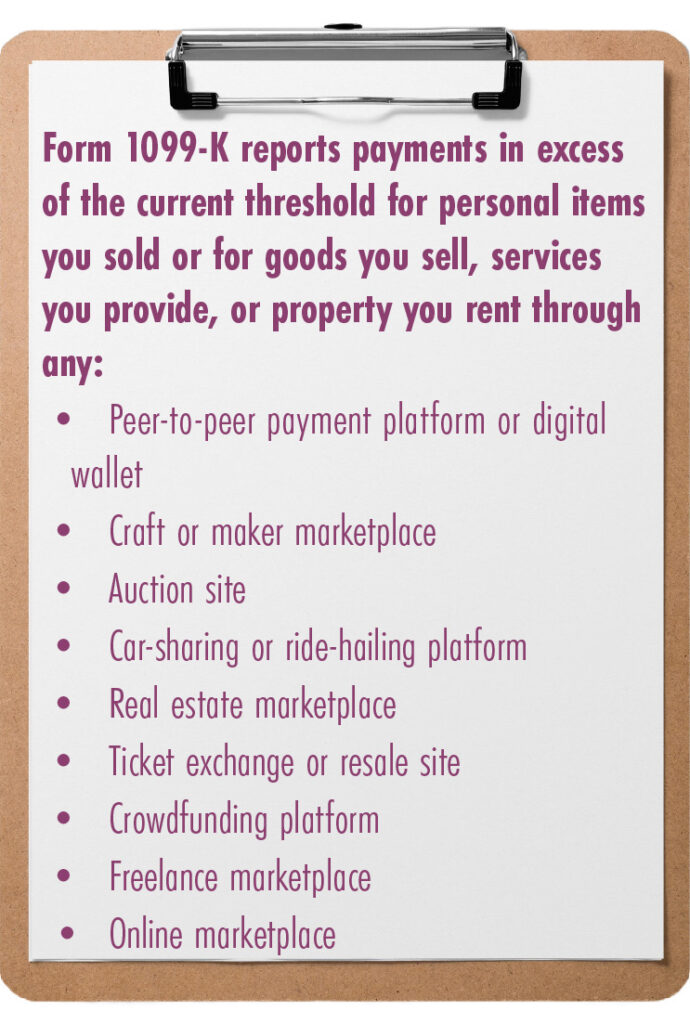

In an unexpected move, the IRS has postponed enforcement of a 2021 American Rescue Plan provision affecting self-employed people who earn money on third-party platforms like eBay, AirBnB, Etsy, VRBO or have payments processed by services like Venmo and PayPal. The provision would have required these platforms to report gross payments of $600 or more to you and the IRS in 2023.

Now, for 2023 tax filing, the previous reporting threshold of more than 200 transactions per year exceeding an aggregate amount of $20,000 remains in effect. The provision does not change what counts as income or how tax is calculated—just what the online platforms have to report to the IRS. You must still track and report your online sales and services income. Your tax professional can tell you more.