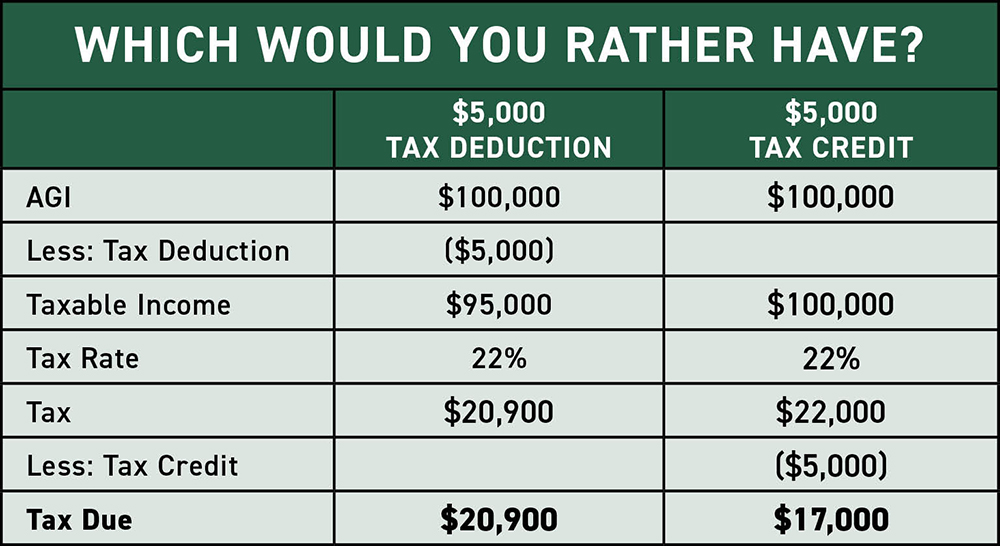

Tax credits and tax deductions may be the most satisfying part of preparing your tax return. Both reduce your tax bill, but in very different ways.

DEDUCTIONS

Deductions reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So, if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

CREDITS

Tax credits directly reduce the amount of tax you owe, giving you a dollar-for-dollar reduction of your tax liability. For instance, a tax credit valued at $1,000 lowers your tax bill by $1,000.

Generally, tax credits are more valuable than tax deductions. However, there are times when a deduction can be more useful if it reduces your adjusted gross income (AGI) to allow you to take advantage of tax breaks you wouldn’t receive if your AGI were higher.

REFUNDS

Some tax credits are refundable or partially refundable, like the child tax credit or the American opportunity tax credit. That means if your calculated tax is $600 and you have a refundable tax credit of $1,000, you’ll receive a $400 refund. But most tax credits are non-refundable. That means you won’t receive a refund if using a tax credit reduces your tax bill below $0.