Bonus depreciation is a valuable tax-saving tool for businesses. It allows your business to take an immediate first-year deduction on the purchase of eligible business property.

HOW IT WORKS

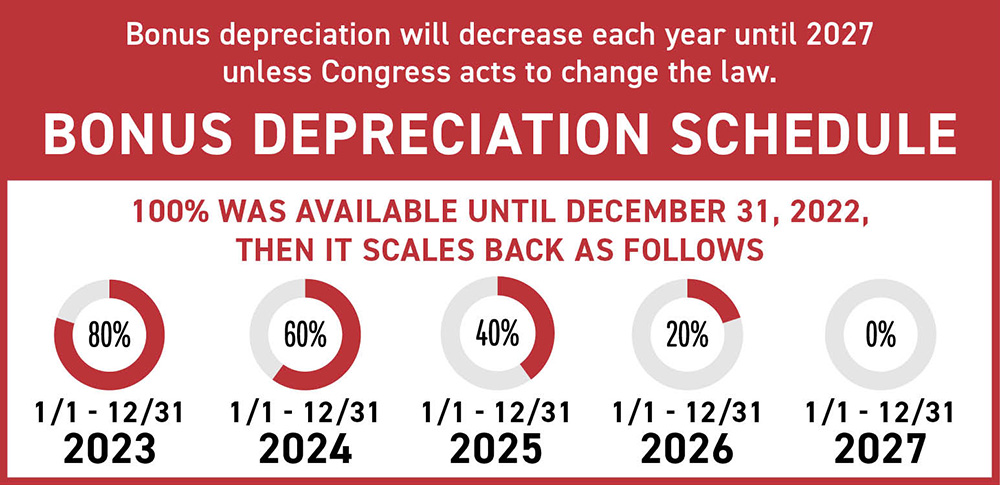

Bonus depreciation is a method of accelerated depreciation that allows a business to take an additional deduction of 80% of the cost of qualifying property in the first year it is put into service. You can take the deduction for new or new-to-you equipment.

Before 2023, you could deduct 100% of the cost. Now, 80% is deductible in the first year. The remaining 20% gets deducted over the asset’s life.

This special deduction allowance is an additional deduction you can take after you take the Section 179 deduction and before you figure regular depreciation for the year.

QUALIFICATIONS AND RESTRICTIONS

To qualify, the deduction must be first used in the year you are claiming the first depreciation deduction.

Only certain types of property may be eligible for bonus depreciation. The item must be:

- Owned by the business

- Used in your business or income-producing activity

- Usable for a determinable lifespan (generally less than 20 years)

- Expected to last more than a year

Also, if you choose bonus depreciation for one of your company vehicles, you’ll need to claim it for all your vehicles. Unlike Section 179 depreciation, you cannot be selective.

WHAT IT MEANS FOR BUSINESS

Claiming bonus depreciation for your business can help lower your taxable income. You may even create a taxable loss by claiming bonus depreciation (unlike Section 179 depreciation).

Beware that bonus depreciation will phase out to zero effective January 1, 2027. (See the graphic above).